Whether it eventually proves to be true or not, examining the case for and against peak app does surface a number of relevant insights to consider as you chart your company's mobile apps' path forward.

The Case for Peak App

As background, I'm unsure where the term "peak app" originated; the first reference I've found online is from late 2014, apparently triggered by a Deloitte/UK study on the mobile consumer.

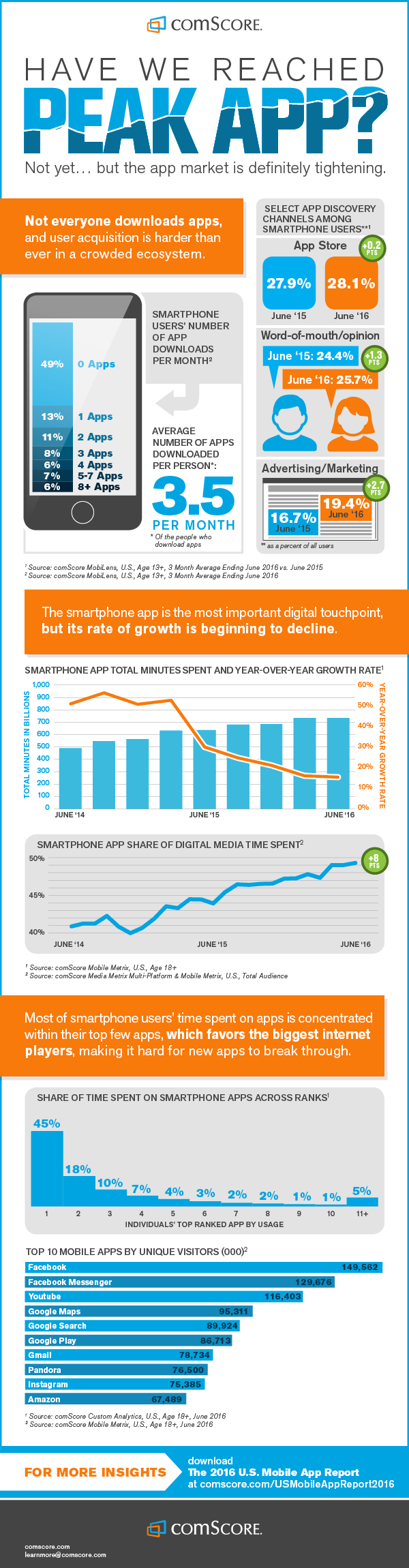

Since then the concept of peak app has appeared sporadically in the tech media and sometimes elsewhere. The concept picked up steam in 2016 when comScore published the 2016 U.S. Mobile App Report that included the following infographic:

As you might expect, much of the published thinking around peak app is why it's true. And there are clearly some compelling arguments to be made in favor of the peak app theory:

- While smartphones' share of digital media time continues to slowly increase, it's concentrated in fewer apps, dominated by Facebook, Google and their associated properties, which own the top six (and eight of the top 10) most-used apps

- The mobile app ecosystem is saturated; most people don't download a single new app in any given month even though 40k+ new apps are added monthly to the app stores

- Consumers spend almost half of their phone time on a single app (usually their primary social network) and 90% of their time on the five apps that they use the most

- Consumer consciousness of potentially detrimental impact of obsessive smartphone use

As quoted in a Fast Company article, Brian Roemmele, an independent tech consultant who specializes in voice and commerce, says that "Peak app has already happened... The new iPhone is going to do great, and it’s going to change a whole lot, but it’s not going to induce more and more app downloads. So that economy has shifted."

On another front, tech giants like Amazon, whose Fire Phone was a major flop, have a significant interest in pushing the peak app narrative as they've watched from the sidelines as Apple and Google revolutionized personal computing.

Also quoted in Fast Company: "Mobile behavior is already set with consumers typically using about five apps a day on a mobile device, making it harder for brands to get users to discover and download new apps on their devices," says Ambika Nigam, Bloomberg Media’s global head of mobile app products. "However on Alexa, if you’re having a conversation and can organically weave your brand and content into the mix, it can potentially become easier for users to discover your skill."

In any case, these facts and opinions indicate that new consumer-facing mobile apps have a truly uphill battle in the stiff competition for consumer eyeballs and digital time share--and not just from other apps.

The Case Against Peak App

Given the peak app theory's arguments why would an enterprise or brand still make mobile initiatives a focus? Here a few counter points from comScore's 2017 report:

- Mobile users spend 16x as much time with apps vs. the mobile web

- Mobile apps consume over 50% of consumers' digital media time; desktop apps are a distant second at 34%--and the mobile web only sees seven percent

- App usage--and a willingness to pay for apps--is much more common for younger users than older users

In a blog post titled "Why the Concept of Peak App is Just an Urban Legend" David Bolton points to several reasons why peak app is just not so:

- Sensor Tower's latest report says that there were 13.2 billion installs in the second quarter—an annual growth rate of 12% or around 1.44 billion installs

- Uber surpassed Facebook in terms of installs for Q2 2017--installed 6.5 million times compared to the six million downloads for Facebook’s core app

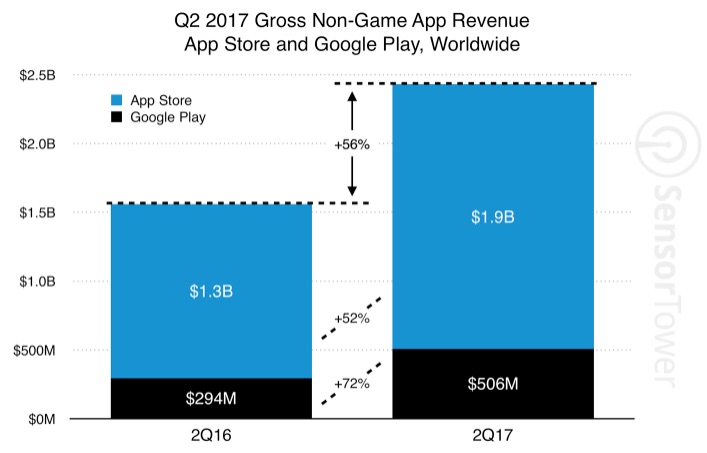

- The Apple App Store had a year-on-year revenue growth of 52%, with Google Play showed an annual growth rate of 72%

Peter Dolukhanov earlier this year examined peak app theory and adds:

- Mobile minutes have already increased 11% [in the UK] since March of this year [2017] with apps dominating that time

- On a per-user basis, average app time up 14% in the last 6 months, and with users now spending on average almost 63 hours a month on mobile apps, versus 14 on mobile web

In summary, the case against peak app is that overall mobile app usage continues to grow in just about every measurable way and that consumers will increasingly pay for great apps (and not just games).

Magenic's Perspective

In Magenic's Mobile Practice experience we see two additional reasons to remain bullish on mobile apps.

First, mobile apps are the "connective tissue" that tie together digital experiences of all types from IoT to digital reality to artificial intelligence and machine learning. (Check out our webinar on emerging technologies, digital transformation and mobile.)

Second, we believe that emerging technology is enabling completely new experiences for which mobile apps will be the window to the world.

In short, no other technology platform is so well positioned in terms of market penetration, context, immediacy and technical capability to enable brands to communicate effectively with their customers.

Conclusion

So, should peak app concern you? Maybe. Whether or not peak app theory proves true, mobile product owners clearly must consider that while increasing audiences and share of digital time suggest there is still room for app growth, there are significant challenges to overcome to succeed in the consumer-facing app market.

No comments:

Post a Comment